FastPay MicroFinance is a licensed microfinance institution that provides financial services to individuals and SMEs across West Africa. Their mission is to make banking faster, simpler, and fully digital for the unbanked and underbanked population.

They approached Stevo Digital to design and build a secure digital banking platform that would allow customers to open accounts, transfer money, pay bills, and manage savings directly from their smartphones.

💡 Challenge

FastPay wanted to transform their traditional banking model into a fully digital financial experience.

Their key challenges were:

-

Slow manual onboarding and account opening processes

-

Limited customer access to financial services (especially in rural areas)

-

Need for instant money transfer and bill payment features

-

Regulatory compliance (KYC, AML) and data security requirements

-

Integration with existing banking core systems

They needed a trusted digital partner capable of building a secure, compliant, and user-friendly fintech app ready for scale.

🚀 Solution by Stevo Digital

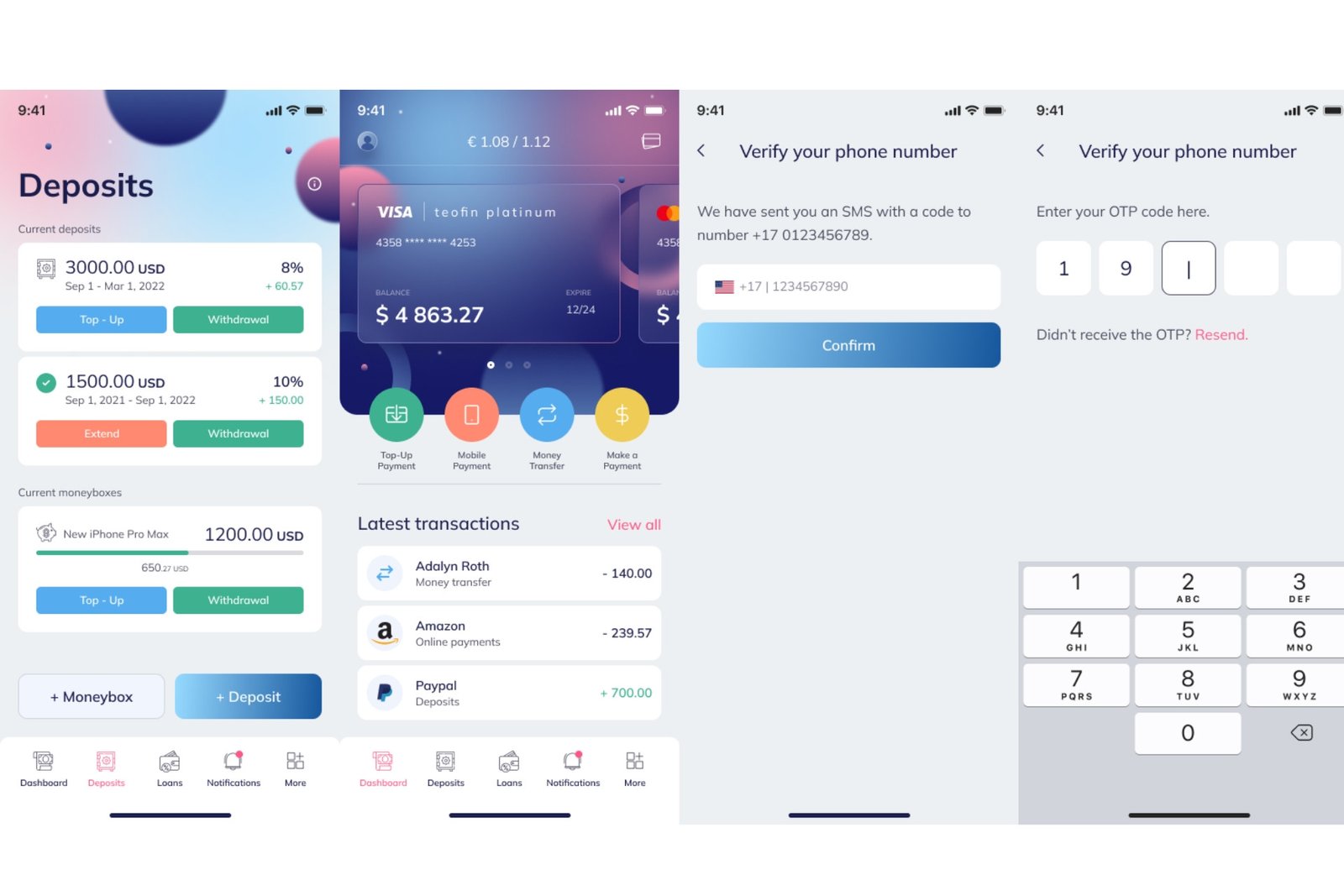

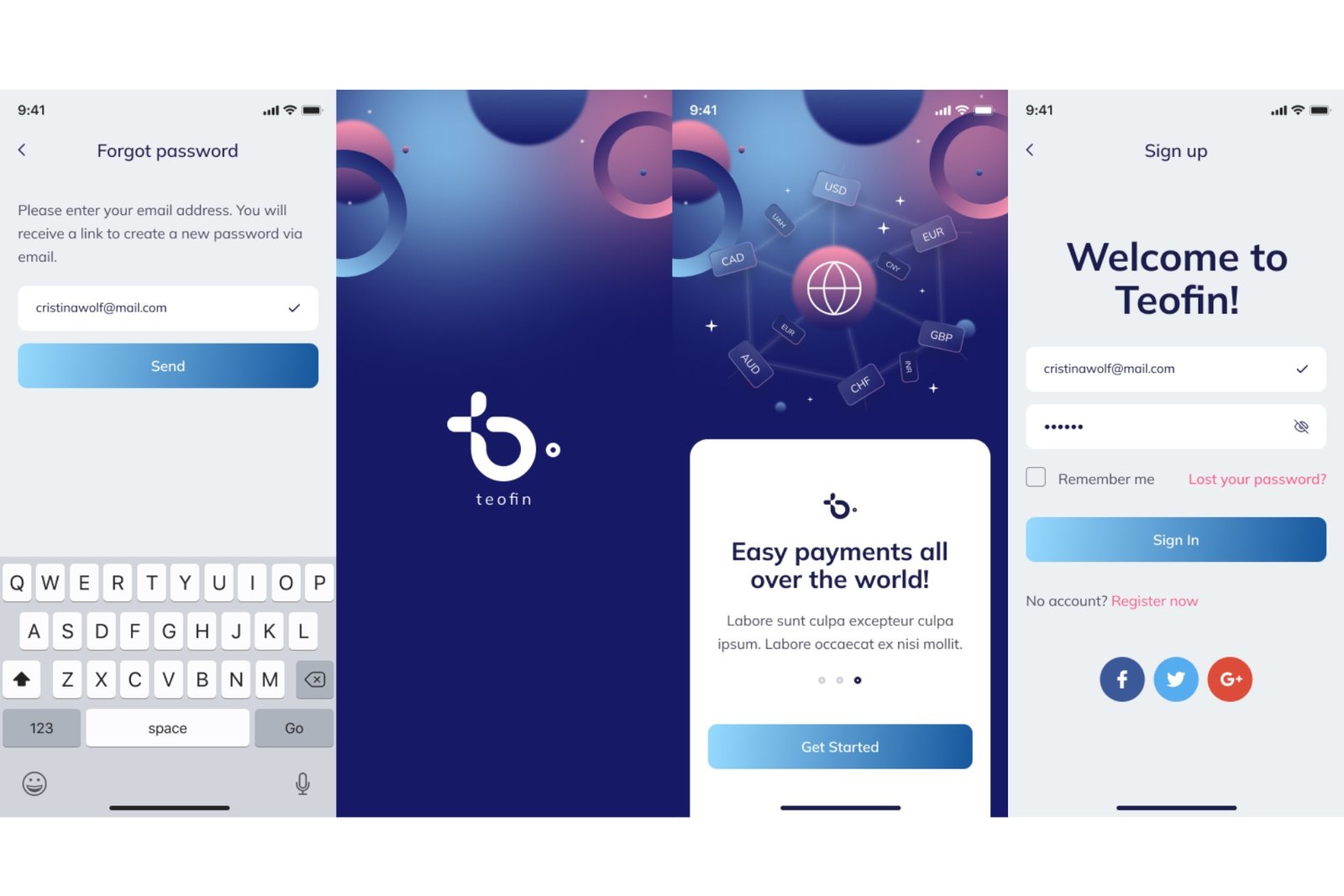

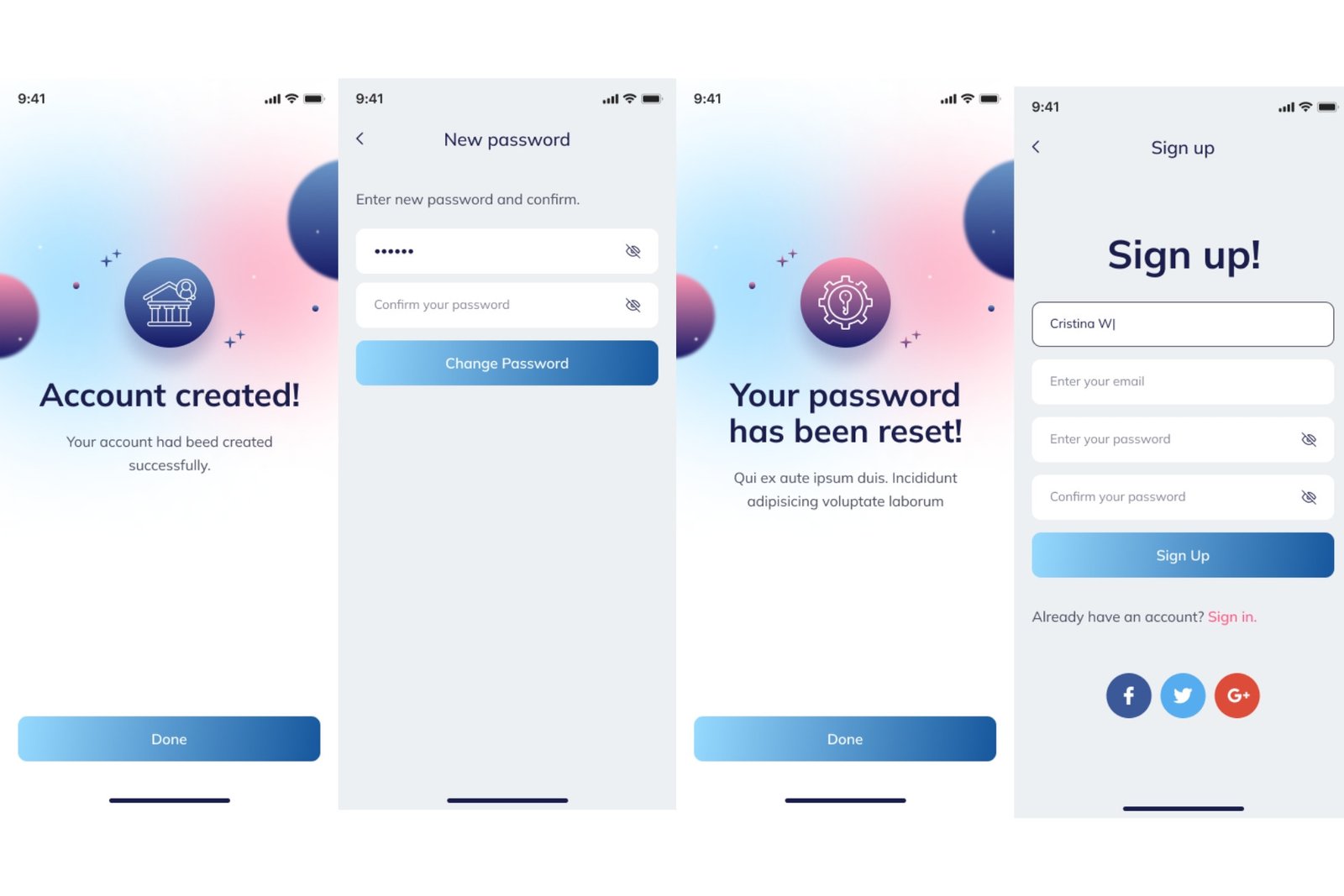

Stevo Digital developed FastPay, a next-generation mobile banking platform designed for both Android and iOS, along with a web-based admin console.

Our solution allowed customers to bank, save, send, and pay — all within seconds.

🔧 Our Deliverables

-

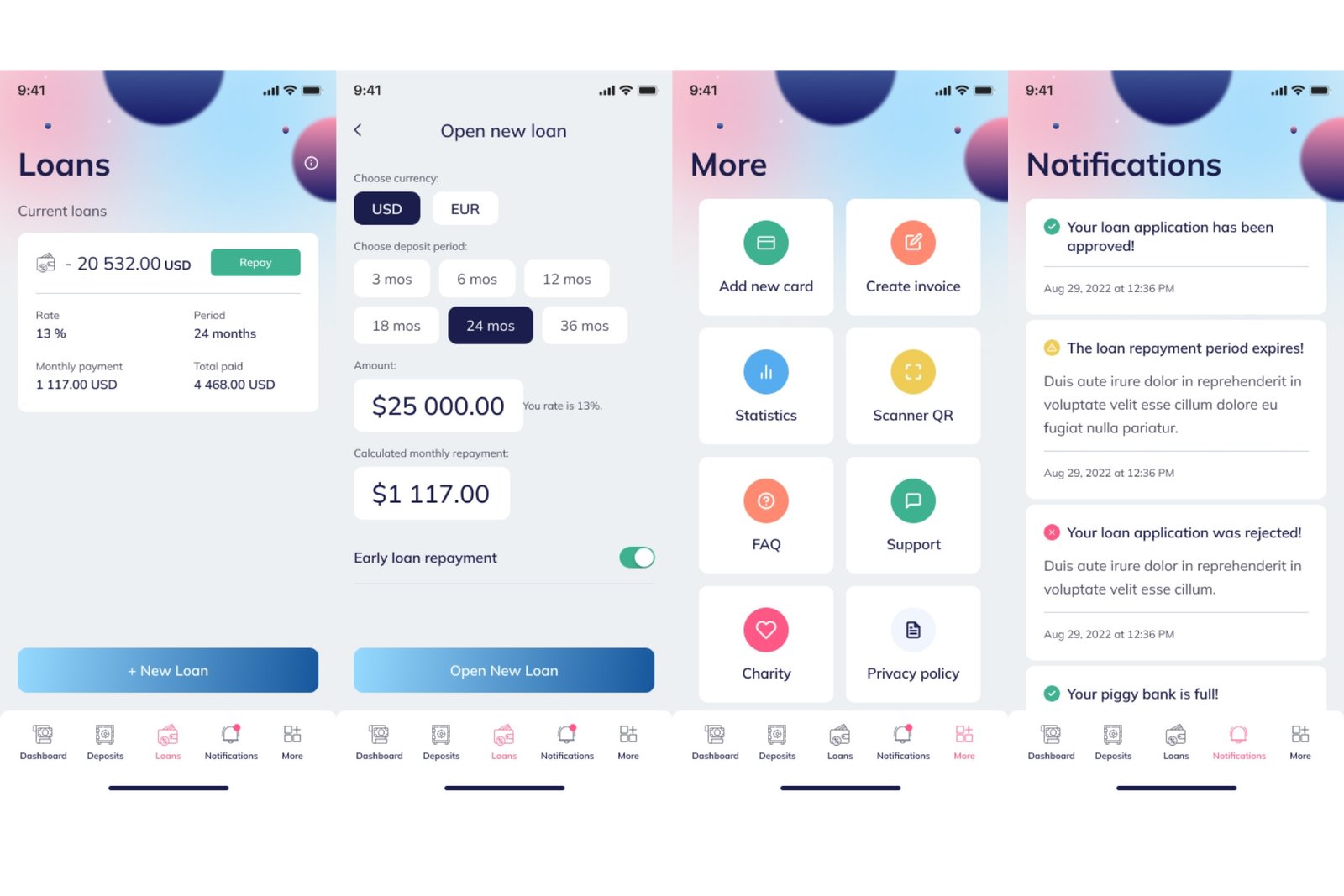

FastPay Mobile App (Android & iOS) – customer interface for banking operations

-

Agent App – for field agents to onboard new users and process transactions

-

Web Admin Dashboard – for compliance, monitoring, and customer support

-

API Integration – with core banking systems and mobile money platforms

-

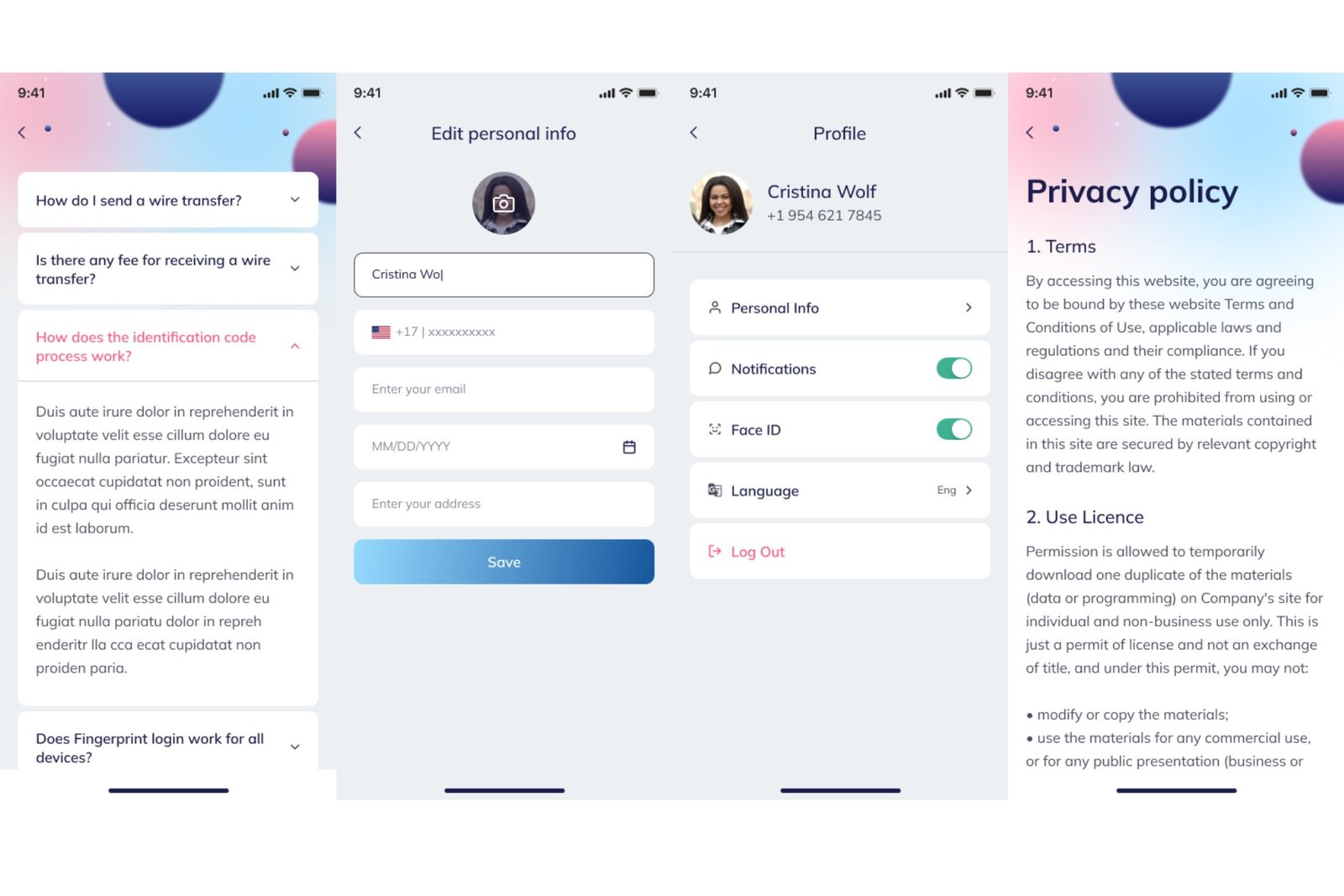

Security Layer – biometric login, OTP verification, and end-to-end encryption

🧩 Key Features

👤 Account Management

-

Digital KYC with ID verification and selfie validation

-

Instant account creation and activation

-

Multi-account management (personal + business)

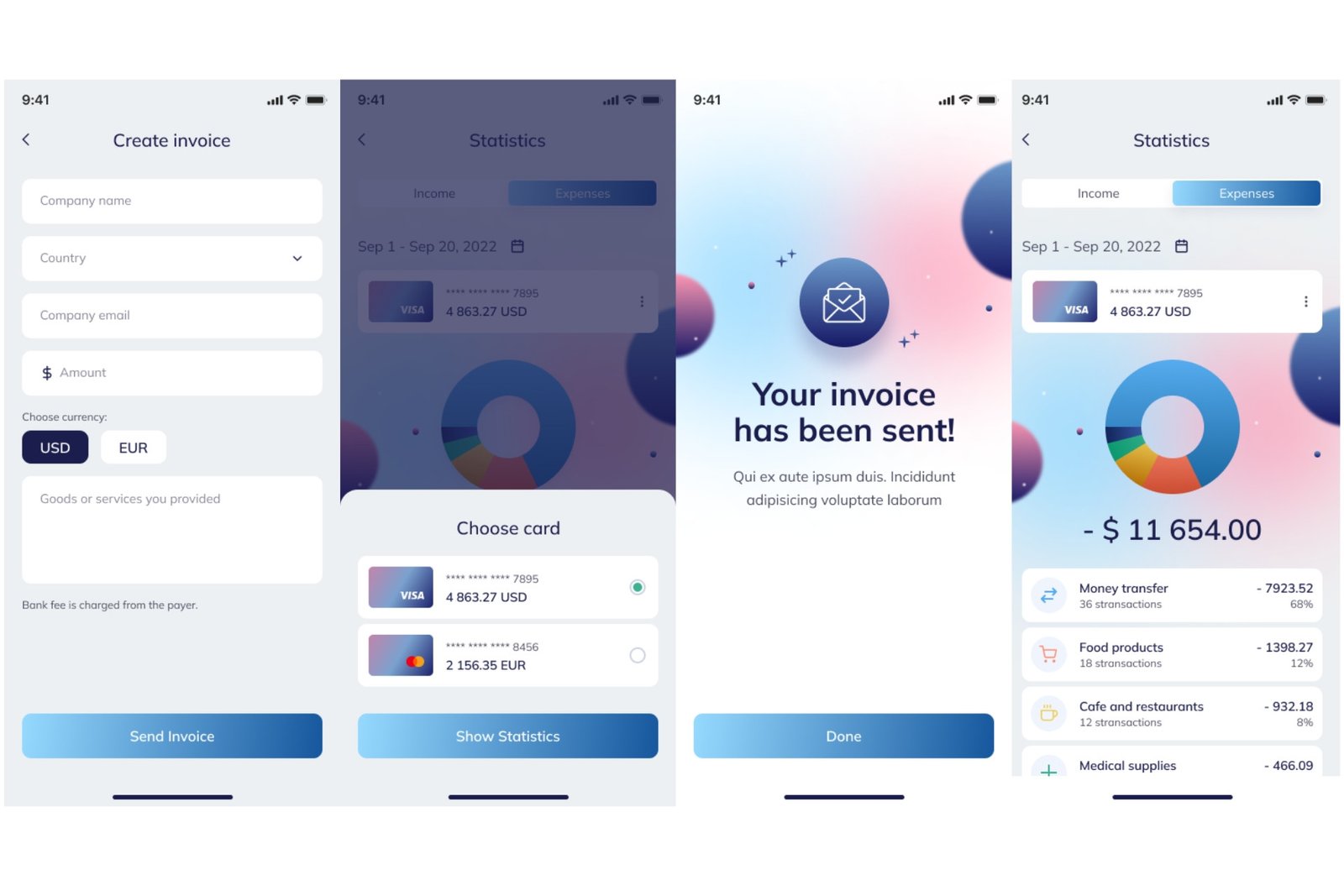

💸 Transactions & Payments

-

Peer-to-peer money transfers (FastPay to FastPay)

-

Interbank and mobile money transfers

-

Utility bill payments (water, electricity, airtime, TV)

-

Scheduled transfers and recurring payments

💳 Wallet & Savings

-

Integrated e-wallet with real-time balance updates

-

Smart savings plans with interest tracking

-

In-app transaction history and downloadable receipts

🔐 Security & Compliance

-

Biometric authentication (Face ID / Fingerprint)

-

Two-factor authentication for all transactions

-

Full KYC verification for users and agents

-

PCI-DSS and ISO 27001 compliant infrastructure

🧠 Analytics & Admin Tools

-

Fraud detection dashboard with alerts

-

Agent and customer performance tracking

-

Real-time transaction monitoring

-

Automated reporting for compliance and audits

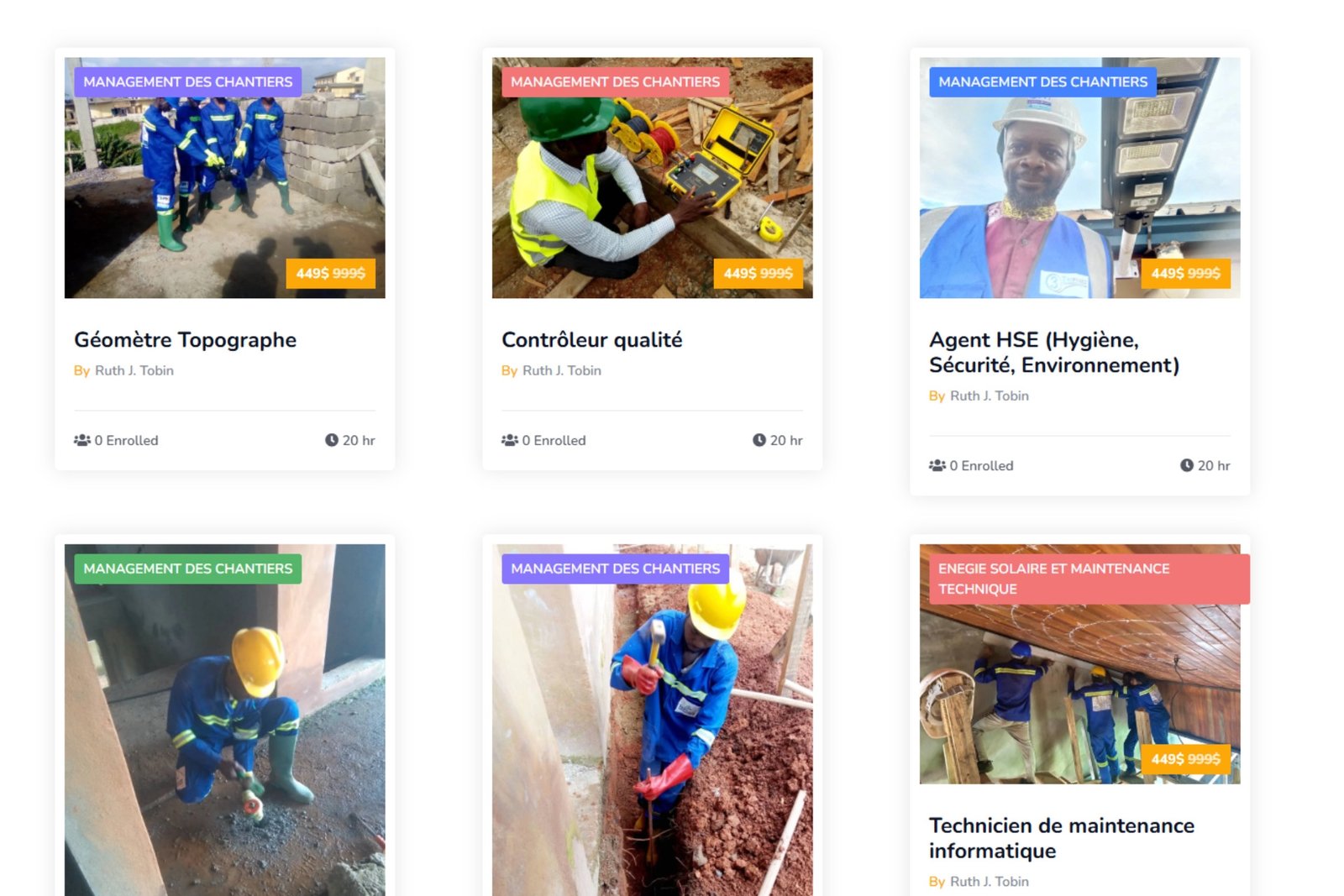

Gallery